Deals fall through. The costs don’t disappear.

Buying or selling a home isn’t just about the right price — it’s about making it to the closing table. And today, a growing number of transactions never get there. Realty Guardian helps reduce exposure to predictable pressure points that can trigger delays, cancellations, and unintended costs.

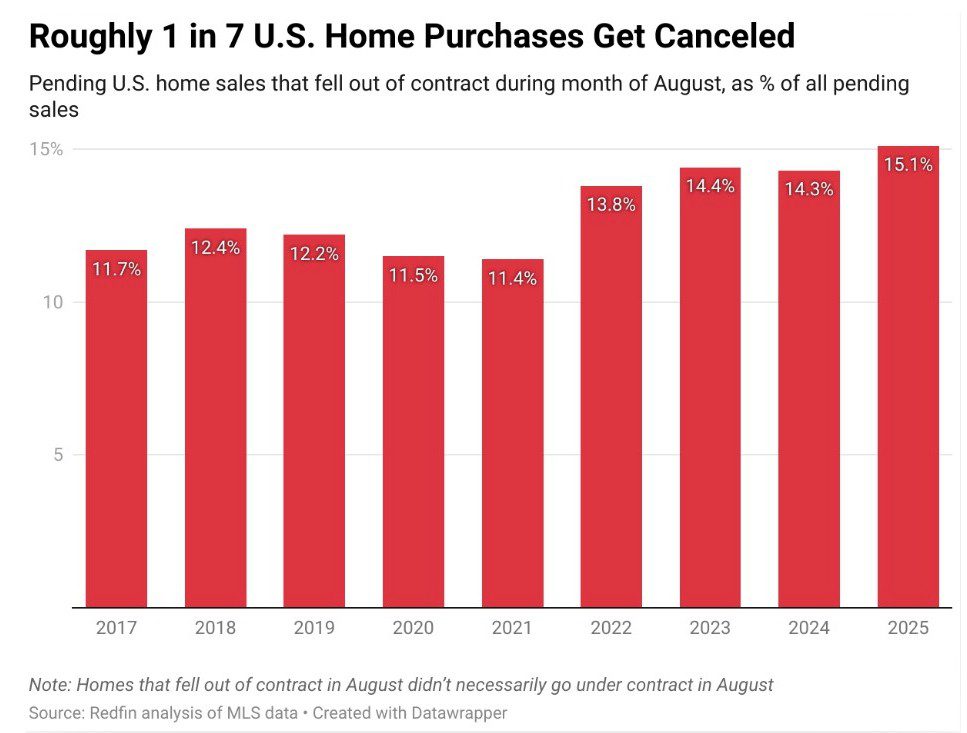

Fall-throughs are no longer “rare.”

Deal failure is no longer a one-off. Redfin’s reporting shows a meaningful share of contracts fall out before closing— often after key deadlines and expenses have already been triggered.

Many cancellations occur after inspections, repairs, or financing steps have started.

Out-of-pocket expenses can be real even when a contract doesn’t close.

Preparedness and safeguards help reduce exposure at predictable stress points.

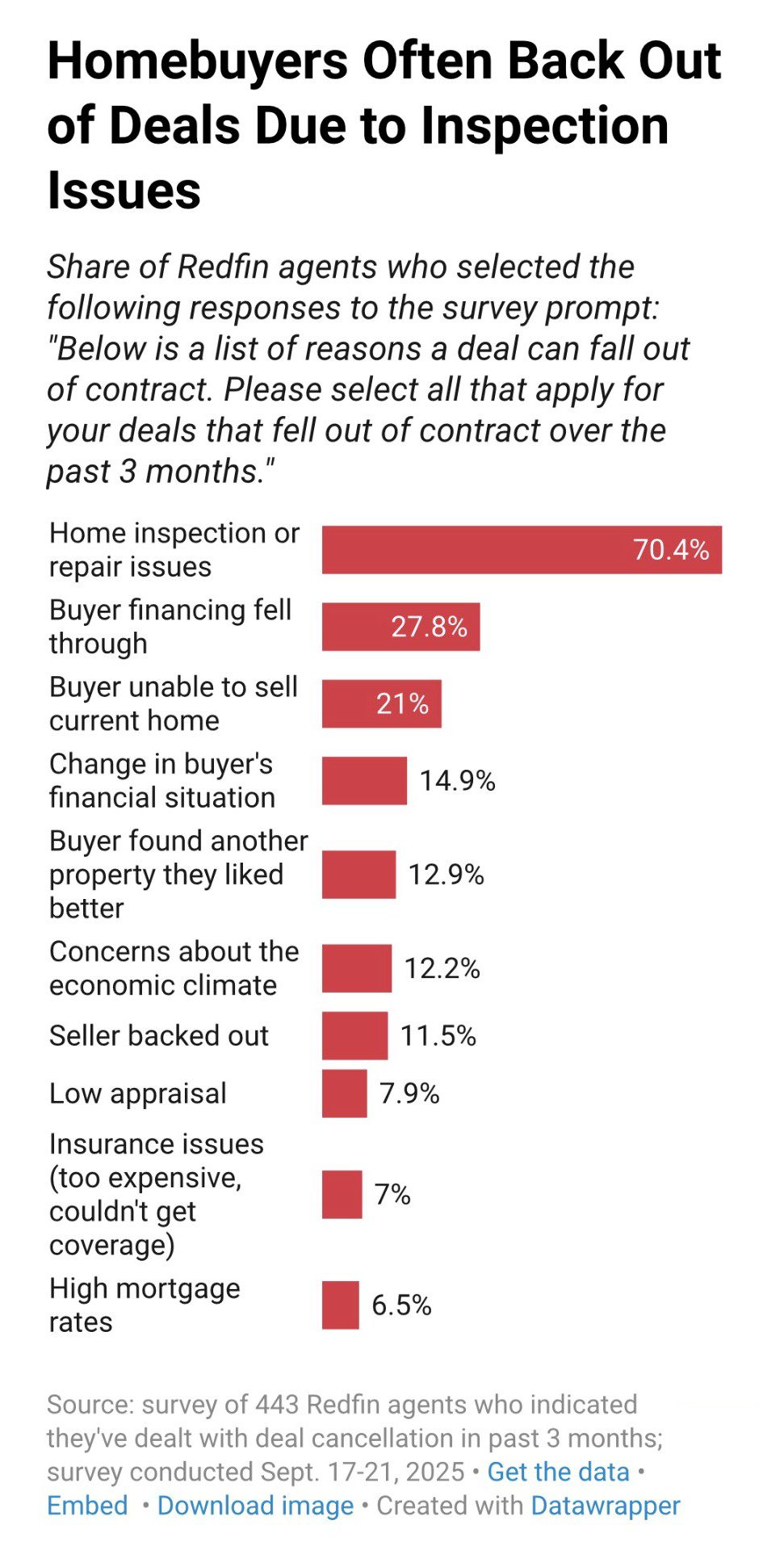

Why do deals fall apart? It’s usually predictable.

Redfin’s agent survey shows most cancellations happen at well-known stress points—especially inspections, repairs, and financing. These moments can create delays, renegotiations, and unexpected expenses.

When a deal fails, the unintended costs can hit both sides

A canceled contract doesn’t simply “reset.” Buyers and sellers often absorb real expenses and disruptions—some immediate, some delayed. Below are common examples many households face when a transaction doesn’t close.

- Inspection costs (home + specialty inspections)

- Appraisal and lender fees (varies by lender and loan type)

- Rate-lock extensions or higher rates if timelines slip

- Time off work for showings, inspections, re-shopping

- Temporary housing/storage if move timing is disrupted

- Opportunity loss if the next home costs more

- Carrying costs (mortgage, taxes, insurance, utilities)

- Stale listing impact and potential price reductions

- Repair/cleanup spending incurred for a buyer who walks

- Moving disruption (trucks, deposits, storage, housing)

- Weakened leverage if market conditions shift

- Restart cost in time, stress, and coordination

How Realty Guardian helps

Realty Guardian is built around a simple principle: real estate transactions deserve protection—not just optimism. RG helps reduce exposure to predictable failure points and supports a calmer, more prepared path to closing.

Clearer planning, cleaner documentation, and better expectations reduce surprises that commonly trigger cancellations.

Inspections, financing, and appraisal are where deals strain. RG-aligned practices emphasize timelines, clarity, and solutions.

Where available, safeguards and member benefits can help soften the impact of certain unexpected expenses. (See plan details for exact terms.)