You Deserve Protection. Not Apologies.

Guardian Agents provide safeguard plans that reimburse eligible buyer and seller out-of-pocket expenses.

Most recent payout: $480 refund to a buyer after a deal collapsed.

You Deserve Protection, Not Apologies.

Guardian Agents provide safeguard plans that reimburse eligible buyer and seller out-of-pocket expenses.

Guardian Agents include up to $11,150*

in transaction safeguards —

no cost to you.

Work with a Guardian Agent and receive a Safeguard Plan designed to reduce financial shock — including inspections, timeline disruptions, wire fraud, and post-closing legal consultation.

- ✓$0 added fees — provided by your Guardian Agent

- ✓Built around real transaction risk areas

- ✓Defined terms, documentation, and limits apply

- ✓*Based on transaction sales price

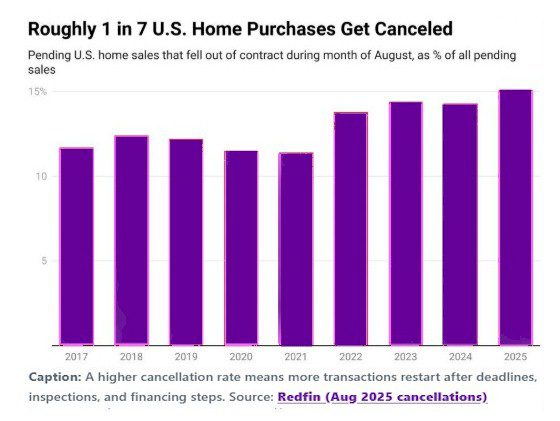

Redfin: A surprising number of home deals never close. Roughly 1 in 7 get canceled.

When transactions collapse, buyers and sellers can face delays, disruption, and unexpected out-of-pocket costs.

Protections in 12 defined risk areas

before, during, and after closing

When you work with a Guardian Agent, you receive

up to $11,150 in transaction protection

at no additional cost to you.

No add-ons. No hidden fees. No increase to your closing costs.

- Inspections or repairs derail the deal

- Appraisal or financing delays create added expense

- Wire fraud attempts during funds transfer

- Buyer delays stall timelines

- Carrying costs continue while deals shift

- Post-closing disputes or fraud still arise

- Great agents guide — but risk still exists

- Contracts don’t cover unexpected out-of-pocket losses

- Safeguard Plans address 12 defined risk areas

We’re Redesigning Real Estate Protection

Realty Guardian® was created by real estate professionals who’ve seen what happens when a deal falls apart — and how expensive “surprises” can get. Guardian Agents add practical safeguards that help buyers and sellers stay protected when plans change.

- Built for real-life problems — delays, disputes, failed inspections, unexpected costs, and more.

- Protection that follows the transaction — safeguards vary by role (buyer/seller) and price range.

- A better experience — less stress, more clarity, and stronger accountability from start to finish.

Buyers & sellers • one protection mindset

Protection before, during, and after your real estate move.

Realty Guardian helps buyers and sellers reduce financial shock, protect against wire fraud, and access defined post-closing legal consultation protections — delivered through Guardian Agents and price-based Safeguard Plans (terms and limits apply).

Preparedness + safeguards

Better planning, clearer expectations, and proactive guidance—so you make smarter decisions under pressure and avoid preventable surprises.

Reduce the financial shock

If a transaction fails to close, a Safeguard Plan may help reimburse certain eligible, documented out-of-pocket expenses, subject to plan terms and limits.

Fraud + legal consultation support

Defined protections for wire fraud and post-closing legal consultation may apply under plan terms, limits, and documentation requirements.

Great agents negotiate. Guardian Agents also help you prepare for the risks people don’t see coming—so one surprise doesn’t derail your move.

Plan tiers are determined by the transaction price range (listing or purchase price)—not “picked” by the client. Benefits (if offered) follow the plan’s definitions, limits, and eligibility rules.

Protection Built for the Real World

Buying or selling isn’t risky because people are careless—it’s risky because timelines shift, details get missed, fraud attempts happen, and post-closing questions can still require legal guidance. Guardian Agents deliver price-based Safeguard Plans designed to reduce financial shock and provide defined protections (terms and limits apply).

Seller Protection Safeguards

Protect listing momentum and reduce avoidable surprises—inspection and repair pressure, appraisal issues, timeline delays, fraud exposure around proceeds, and defined post-closing support for legal consultation needs (terms apply).

Explore Seller ProtectionBuyer Protection Safeguards

Make smart decisions under pressure—inspection and appraisal friction, financing and timeline disruptions, wire fraud exposure during funds transfer, and defined post-closing legal consultation protections when questions arise (terms apply).

Explore Buyer ProtectionMotto

Protect the deal. Empower the client. Support the dream.

Bad deals happen. We don’t guess which ones — we prepare for all of them.

Mission

We protect buyers and sellers with innovative safeguards that reduce financial risk and restore peace of mind.

Vision

A real estate experience where clients feel secure, supported, and confident — even when the unexpected happens.

Why Protection Matters in Real Estate

We’re not just adding safeguards — we’re restoring confidence to real estate transactions.

Buying or selling a home is personal. When something goes wrong, the cost isn’t just financial — it’s emotional. Guardian Agents exist to protect clients from those moments and guide them with care, clarity, and accountability. This isn’t about fear. It’s about being prepared — and feeling supported every step of the way.

“Real estate is personal. When we protect the deal, we protect people — and that’s what truly matters.”

Safeguarding Your

Real Estate Deals — Before They Have a Chance of Breaking.

In this one-minute video, see how Realty Guardian® helps protect buyers and sellers from unexpected expenses that can arise during real estate transactions—through exclusive Safeguard Plans available only through Guardian Agents. Save up to $11,150 in unexpected costs — no cost to you.

How it works

Protection in 3 Simple Steps

Quick overview: choose a Guardian Agent, know what applies to your price range, and get help if an eligible issue occurs.

Choose a Guardian Agent

Work with a trained agent who brings safeguards into your transaction.

Receive Safeguards

Protections are matched to your role (buyer/seller) and price range.

Claim Support if Needed

If an eligible issue hits, your Guardian Agent helps guide next steps.

Real Proof When Things Go Sideways

These are real situations buyers and sellers face. Guardian Agents help reduce the financial sting when plans change.

“Our sale collapsed, and we were stuck with two mortgages. The holding-cost support gave us breathing room to find a new buyer.” That support changed the entire outcome for us — we stayed afloat and kept moving forward.

“We paid for appraisal and inspection, then repairs came in way over budget. Realty Guardian helped reimburse part of our costs and took the sting out.” That support helped us walk away and find a better house without feeling like we lost everything.

“We had major issues and a low appraisal. The protections helped close most of the gap and covered temporary housing during repairs.” It felt like someone actually had our back when the deal got complicated.